Enable credit risk analytics

Leveraging its decades of finance domain expertise, deep analytics experience, and extensive suite of credit risk modeling and strategic solutions, EXL set out to accomplish the client’s business goals.

Challenge

EXL’s client, a UK financial services provider, knew its credit risk analytics function needed to optimize its costs, balance growth and risk, and compete with digital-first organizations. The best way of accomplishing this was by adopting new cloud technologies that could host its data and analytics while lowering expenses, improving performance, enhancing security, and providing scalability. This robust, controlled data platform would then act as a single source of truth for the client’s business and analytics needs.

Standing in the way of realizing this goal were several obstacles:

- Legacy platforms created issues including poor data latency;

- Slow query performance

- Frequent load errors

The presence of multiple complex data sources and numerous redundant data marts rendered data analysis inefficient and ineffective, while missing capabilities in data visualization and operational automation caused these processes to be time- and cost-intensive. Inconsistent data incorporated from years of past portfolio acquisitions created regulatory risks. A lack of shared metrics led to different teams returning different results from their analysis, leaving the business without the single source of truth it required.

To overcome these challenges and meet its objective, the client turned to EXL for help in transforming its credit risk analytics function and carry out a successful migration onto the cloud.

Solution

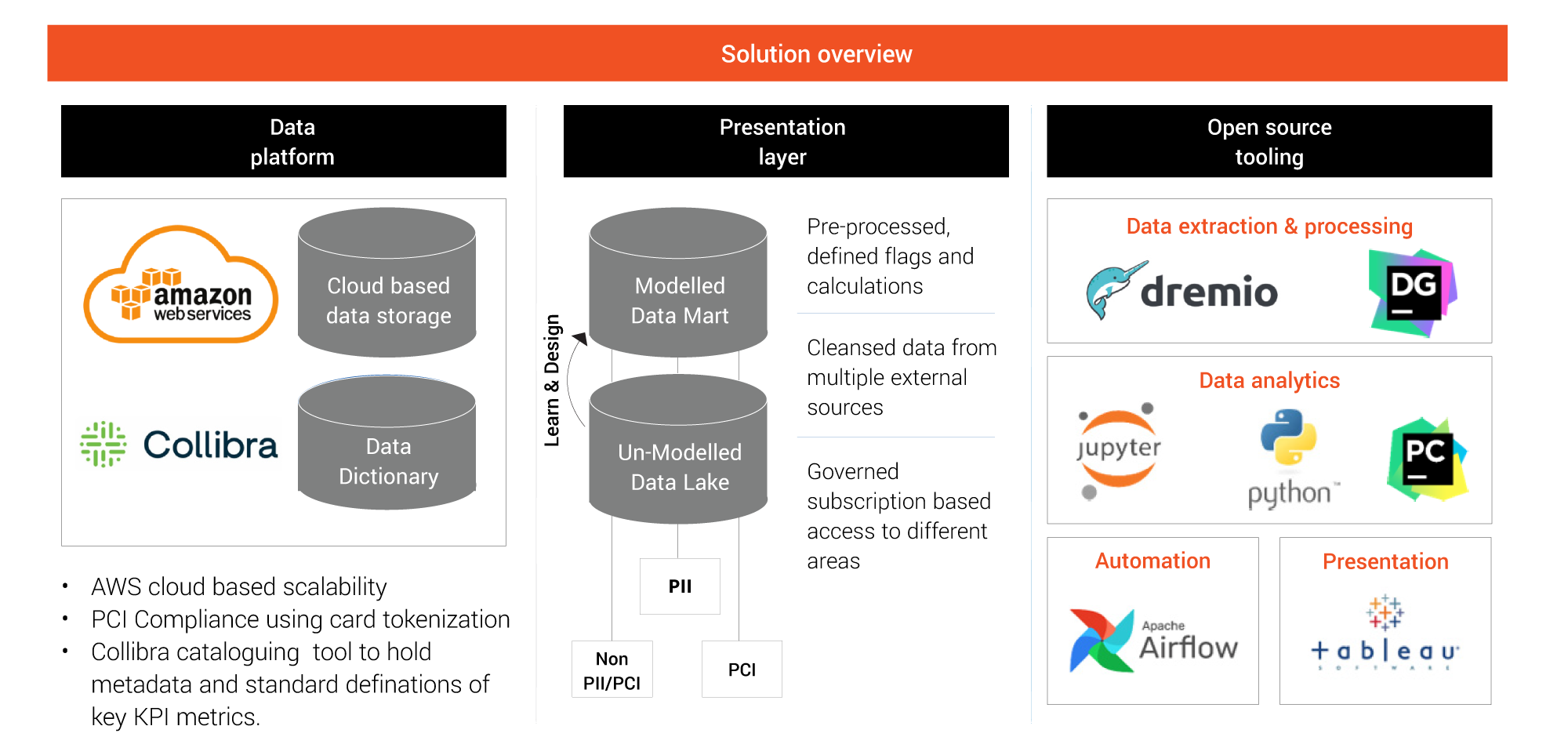

Leveraging its decades of finance domain expertise, deep analytics experience, and extensive suite of credit risk modeling and strategic solutions, EXL set out to accomplish the client’s business goals. Successful analytics programs are built on a foundation of solid data. EXL implemented a data platform utilizing Amazon Web Services for cloud-based data storage to ensure scalability. A Collibra-powered data dictionary organized and catalogued the metadata, as well as provided standard definitions of key performance indicators. Additionally, all payment card data held within the database was tokenized to ensure payment card industry (PCI) compliance.

Data from multiple external sources was cleaned and placed into a data lake. User access to this data was based on a subscription-based governance model in compliance with all relevant PCI and personally identifiable information (PII) regulations. Additionally, a modeled data mart allowed this data to be pre-processed, defined, and analyzed as needed.

Enhancing this solution was an extensive suite of tools. Data extraction and processing was carried out using Dremio and DG, while data analytics were handled using Jupyter, Python, and PC. Airflow-based automation and Tableau data visualization made interacting and analyzing this data a simple, intuitive process.

Outcome

The successful cloud migration enhanced the effectiveness of the client’s credit risk function while lowering its costs. Open-source applications and a “pay only what you use” data platform resulted in decreased spending. Powerful data and analytics interventions provided up to a fivefold performance increase in data extraction, processing, and report creation. Intuitive tolls and self-service dashboards minimized the complexity of the system, supported a broad range of skill levels, and improved overall user experience. This provided the client with the single source of truth they needed and positioned them to better balance risk and growth in the future.