EXL Transaction Insights improves underwriting for a US lender

Challenge

A top US financial institution wanted to leverage its bank transaction data to improve their underwriting process, thus improving their approval rate and credit performance. However, they struggled with systematically extracting key insights from the unstructured transaction data and creating smart variables. By partnering with EXL to implement the EXL Transaction Insights solution, the client was able to overcome these obstacles and achieve their goals.

Solution

Using the EXL Transaction Insights solution, the client began to generate insights to drive better decision.

EXL identified the following to solve for client’s need

- Systematically approve customers with strong cash flows and stable bank accounts

- Decline customers showing evidence of financial difficulties and high credit risks based on their bank account

- Verify self-declared customer revenues and generate the best offer set based on their ability to pay

Intelligent operation

Transaction categorization

90%+ transactions categorized in 150+ categories through advanced text mining algorithms

Smart attributes

1,000+ predictive and meaningful variables to evaluate customer financial health

Model development

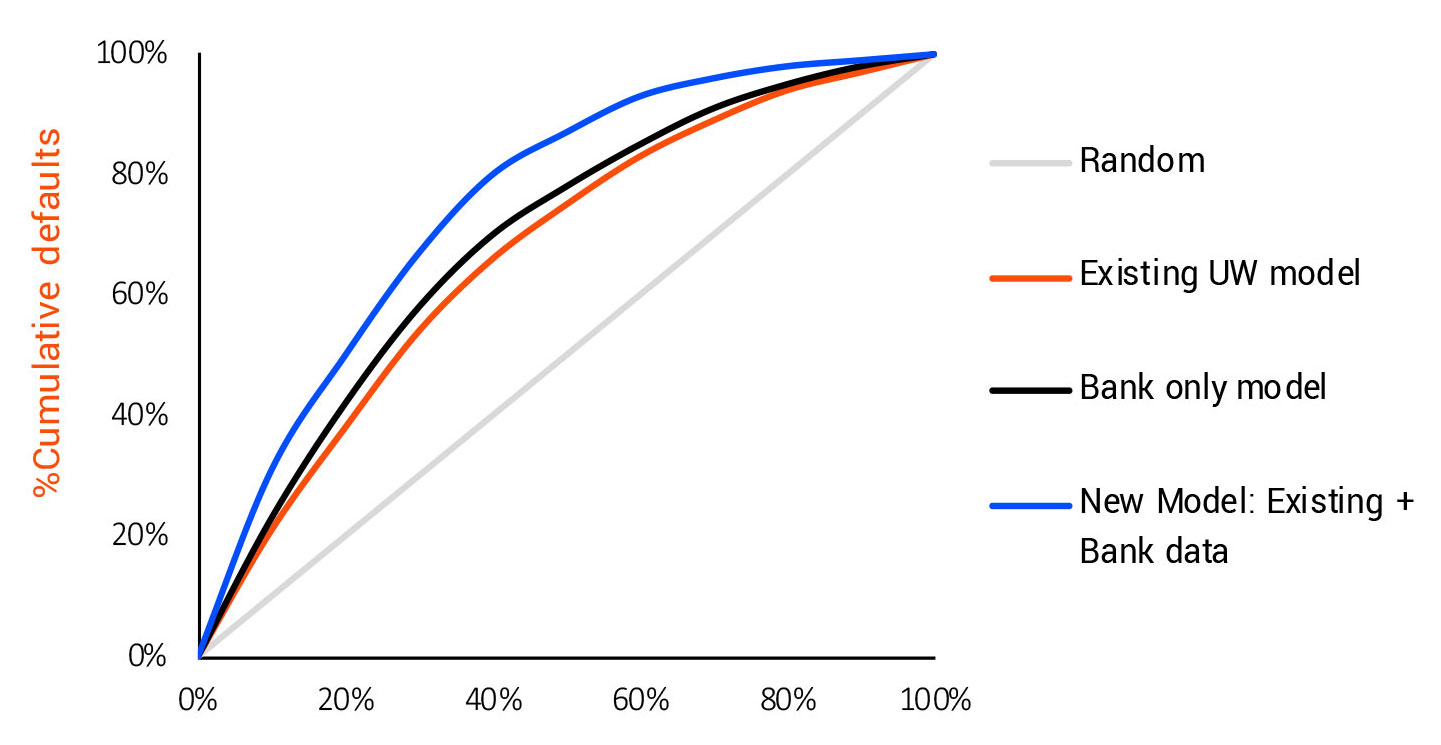

Built credit default model to incorporate intelligence from bank transaction data

Other use case assessment

- Loan amount assessment

- Ongoing monitoring and early warning triggers

- Improve collections

Outcome

15%

Better risk discrimination

10-15%

Increase in systematic decision rate