Accelerating PRA PS 9/24 Compliance

PRA's latest update on capital adequacy, PS9/24, sets the stage for the final credit risk rules, output floor and disclosure requirements under Basel 3.1, now set for January 2026 deadline. While the six-month extension offers some breathing room, the pressure is on for firms to quickly tackle complex data and estimation challenges, thereby stay compliant and capital efficient.

This paper provides a practitioner's view of the new regulation (current capital regime to CP16/22 and further to PS9/24) and leveraging EXL CAPFORT™ to meet prudential requirements at accelerated pace.

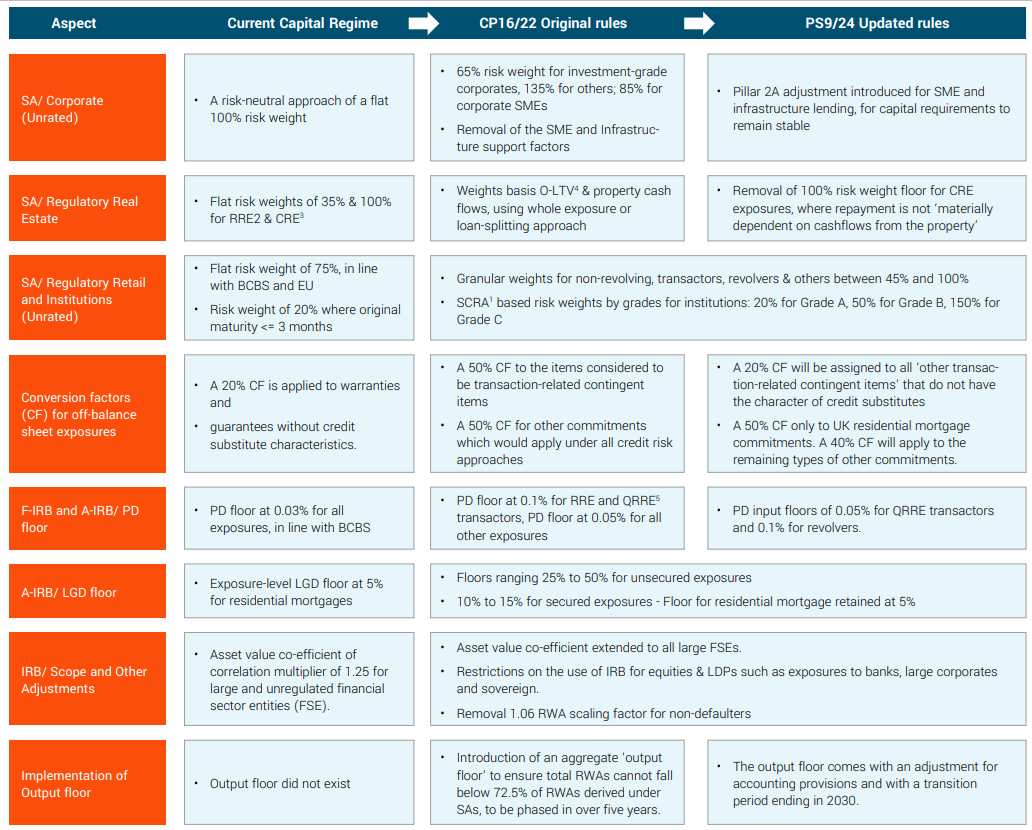

From current capital regime to CP16/22 and further to PS9/24 - Key credit risk updates*

* Apart from this there are additional updates on exposure class allocation, specialised lending, currency mismatch rules, definition of real estate exposures and property valuation rules at origination

1. Standardised Credit Risk Assessment Approach

2. Residential Real Estate

3. Commercial Real Estate

4. Property’s Loan-to-value ratio at origination

5. Qualifying revolving retail exposure

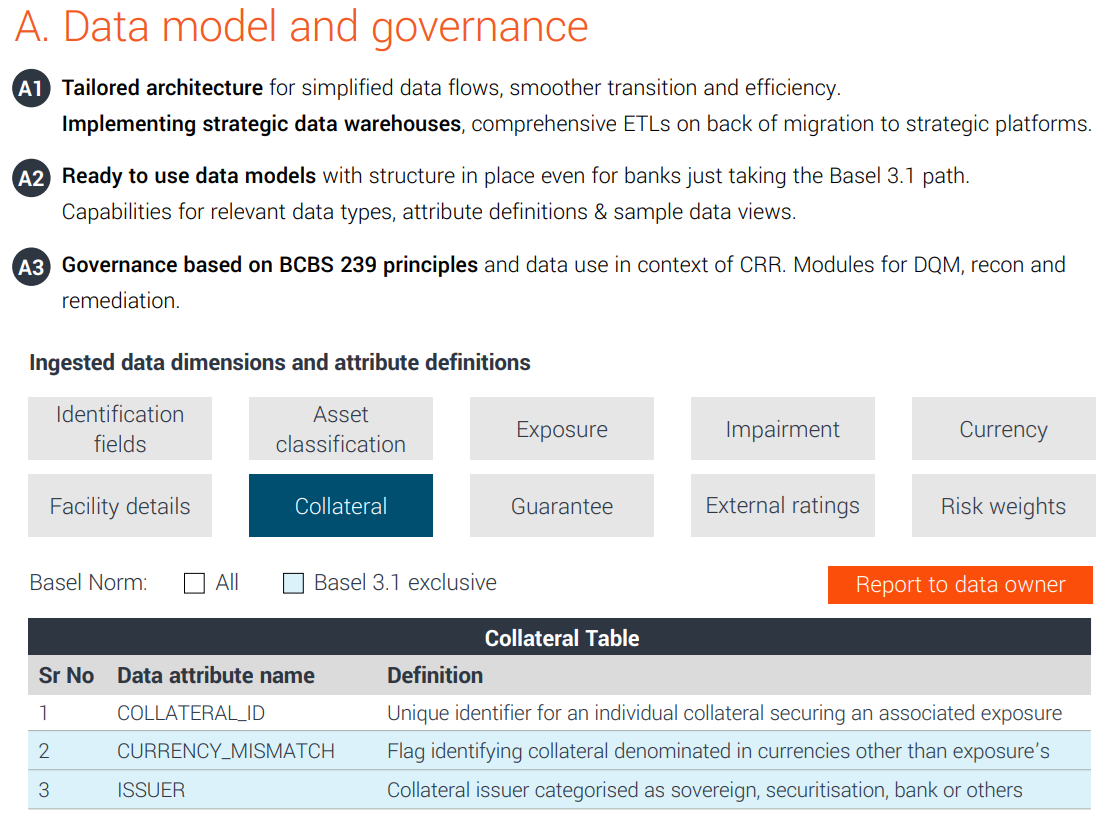

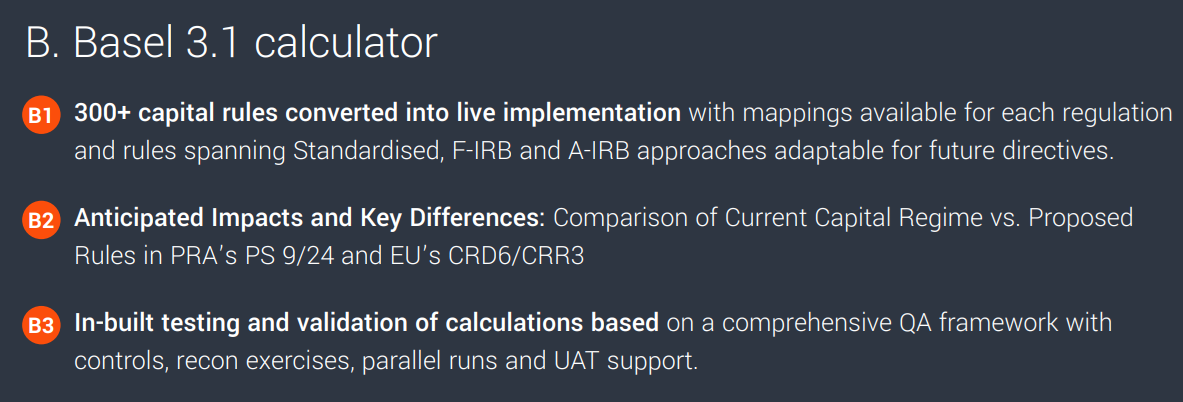

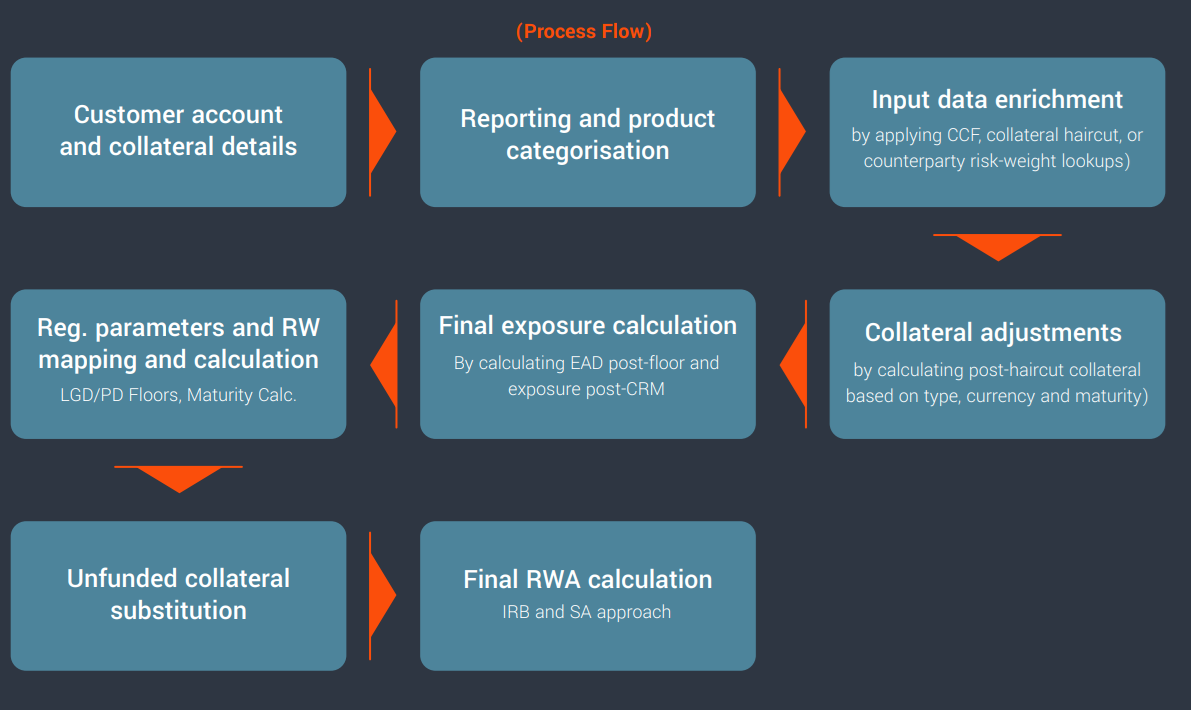

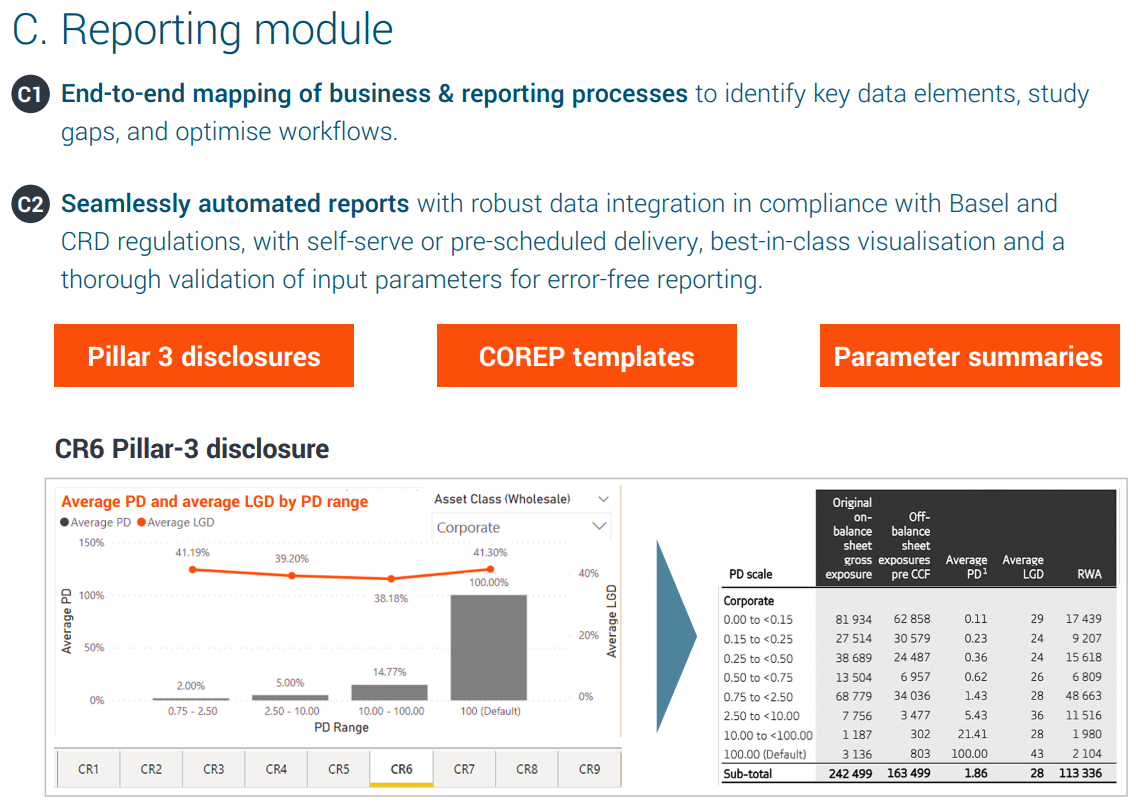

EXL, a leader in regulatory capital and compliance, spent the last two years developing EXL CAPFORT™ to tackle the CP16/22 guidelines. With specialised modules for data modeling and governance, RWA calculation, regulatory reporting, and stress testing, EXL CAPFORT™ keeps firms ahead of the curve. We have now updated it to handle the changes introduced by PS9/24, with its four modules offering a clear roadmap for efficiently implementing Basel 3.1.

Case study 1

Accelerated Compliance:

Delivering Basel 3.1 for Top UK Retail Bank

Context and Challenge:

- A leading UK retail bank needed to comply with Basel 3.1 norms through rapid architectural and calculation adjustments

EXL's Role

- Set-up tailored architecture and data models to streamline the delivery of reforms.

- Implement live RWA calculator amending calculations based on PRA’s consultation.

- Conduct impact analyses, including comparison with BCBS.

Delivery Highlights:

- Analysed, mapped, and simplified business and reporting processes, reducing technical debt.

- Modules for data quality, reconciliation, and remediation

- Delivery well ahead of deadline, followed by thorough testing and ratification of results.

- Bi-annual completion of the PRA's Quantitative Impact Statement (QIS).

Key Success Factors:

- Regulatory interpretation, strategic solution design and operational process optimisation.

- Use of emulators, scenario analyses and output floor comparisons for RWA impact insights

Case study 2

Strategic Risk Platform Implementation:

Basel 3.1 Compliance Success

Context and Challenge:

- A prominent UK commercial bank sought to implement a strategic data warehouse and regulatory calculator for Basel 3.1 readiness.

EXL's Role:

- Lead the modernisation program transitioning from legacy systems to strategic risk platform for regulatory reports and deep dives.

- Develop a robust Quality Assurance framework with governance and controls, to ensure that golden source performs as expected.

- Automate BAU reporting processes and validate input parameters.

Delivery Highlights:

- Implemented GCP (Google Cloud Platform) BigQuery as the strategic warehouse for all ETL (Extract, Transform, Load) and Basel 3.1 reporting capabilities, including RWA, COREP, and Large Exposures calculation.

- Deployed automated reporting systems with robust data integration and insightful visualisation capabilities to ensure timely regulatory disclosures.

Key Success Factors:

- Carefully managed requirements, regulatory interpretation, data elements and QA frameworks.

- Guardrails established to handle Service Level Agreement (SLA) escalations.

To find out more on this and our other risk analytics and data offerings, please contact EXL EMEA Risk CoE: