Document fraud solution

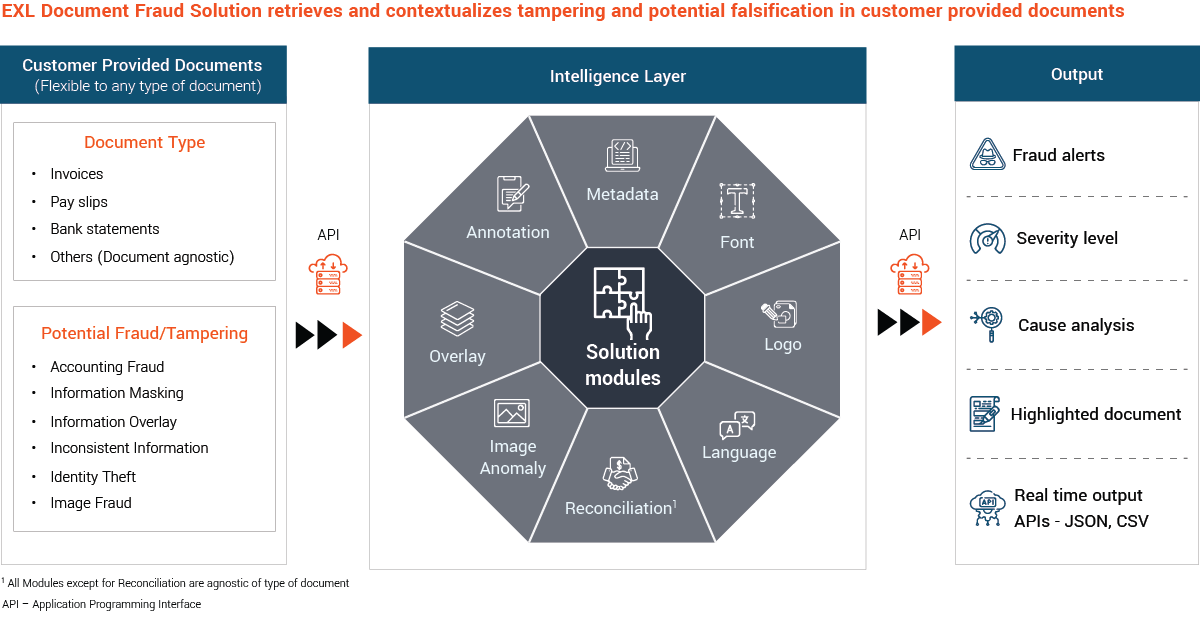

Sophisticated machine learning modules read, analyze, and annotate all your documents in seconds.

Swiftly detect document tampering using AI-based models

Document fraud is increasing at a rate of 20-40% over the last few years, underscoring the need for a more effective detection approach. Traditional manual methods are time-consuming and prone to missing sophisticated alterations and tampering that evade visual detection. This often results in fraudulent documents going undetected among those not sampled for review.

Amateur forgeries are easily spotted by the naked eye, but seasoned forensic experts and machine learning technology are needed to identify intricate forgeries and alterations created by expert fraudsters. EXL Document Fraud Solution processes each document through a suite of modules, using best-in-class machine learning methods to automate the examination of your customer documents.

Key solution features

Document fraud is a pervasive issue that can be hard to detect. With the EXL Document Fraud Solution, your organization can quickly and easily screen for even the most sophisticated fraud attempts in digital and image-based documents.

Document modification

The solution detects and flags alterations made to a document after its creation, regardless of the editing software used.

Anomaly detection

Changes to professional or formal documents could result in anomalies, such as spelling and grammatical errors, misplaced logos, font inconsistencies, or text misalignments These discrepancies are accurately pinpointed by the solution.

Tamper assessment

The solution uncovers concealed information within documents, effectively identifying text or image overlays that are not easily visible to the naked eye.

Reconciliation checks

The solution verifies document consistency, flagging discrepancies such as account number mismatches, unreconciled balances in transaction tables, and inconsistencies and discrepancies in page numbers and dates.

Key focus areas and industries

Financial institutions and banking organizations

Insurance providers

Healthcare providers

Government agencies

Retail institutions

Benefits

How do machine learning and automation stop document tampering and fraud — while saving your organization time and money?

- Faster, real-time detection

Real-time detection allows organizations to identify and respond to fraudulent activities promptly, helping mitigate risks and minimize the impact of incidents.

- Minimal disruption, maximum effectiveness

Customizable, scalable solution meets the various needs and requirements of different organizations across industries — seamlessly integrating with existing systems and workflows.

- Enhanced decisioning, streamlined resources

Increased automation and accuracy allow organizations to refocus resources to core activities — saving veterans for documents flagged as high-risk.

- Increased efficiency, minimized manual effort

Heightened efficiency and accountability of the solution’s machine learning models detect tampering instances that even the most meticulous manual inspections may miss.

Proven outcomes and key results

2-5X

reduction in application pend rate

30-50%

net new identification of fraud cases

~50%

reduction in manual forensics time