Providing a solid foundation for productivity and accuracy

EXL's Digital KYC solution helps automate, streamline and standardize Client Due Diligence (CDD) and Know Your Customer (KYC) processes. The solution leverages advanced analytics/AI, Robotics Process Automation (RPA) and integrations to solve various operational challenges to aggregate 30+ data sources across 20+ countries.

Client testimonial

"EXL’s KYC solution for data integration and screening services helped us integrate data from multiple web sources, reducing turnaround time and saving manual effort. This has greatly increased the speed and efficiency with which we complete our customer onboarding process.. Working with EXL helps us save time, improve efficiency, and present integrated data in format that is ready to be shared."

Product Manager, Leading Investment Bank

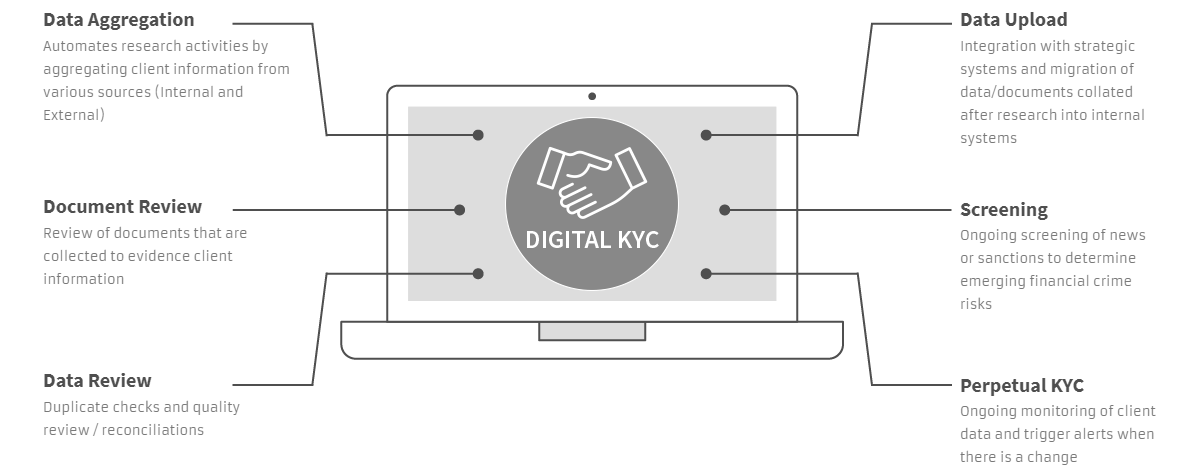

Solution highlights

Data Aggregation

Automates research activities by aggregating client information from various sources (Internal and External)

Document Review

Review of documents that are collected to evidence client information

Data Review

Duplicate checks and quality review / reconciliations

Data Upload

Integration with strategic systems and migration of data/documents collated after research into internal systems

Screening

Ongoing screening of news or sanctions to determine emerging financial crime risks

Perpetual KYC

Ongoing monitoring of client data and trigger alerts when there is a change