Net zero

Climate change increasingly poses one of the biggest long-term threats to investments2.

-Christiana Figueres, Diplomat

Climate change has become recognized as one of the most important issues the world must address. Over the past several years, the goal of reaching net zero carbon emissions has gained prominence among countries and corporations alike.

The Montreal Protocol in 1987, formation of United Nations Framework Convention on Climate Change in 1994, the Kyoto Protocol in 1997, the Copenhagen Accord in 2009 were all successful attempts at increasing awareness on climate change and seek global support. The Paris Agreement of 2015 now serves as the accepted protocol most countries follow. According to the agreement, the aim is to keep the global temperature rise well below 2°C above preindustrial levels and exert effort to limit it to 1.5°C by the end of the century.

Five years after the Paris Agreement, the global effort lacks the rigor and urgency the issue commands. According to the 2020 Emissions Gap report, total emissions in 2019 hit the record high of 59.1 GtCO2, with 64% contribution from fossil fuels, and 11% from deforestation and other harmful land use.

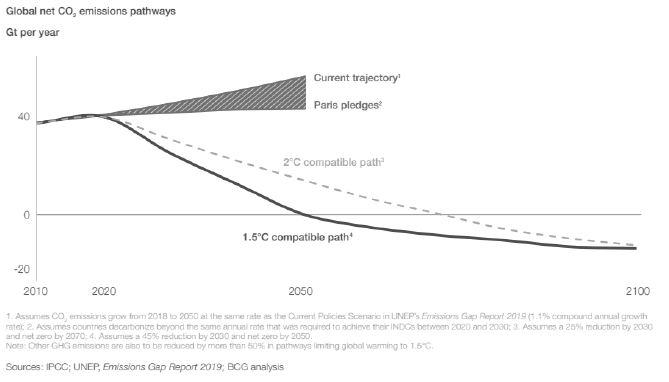

The pursuit of net zero emissions should not be thought as just another compliance norm, but an incredible opportunity for innovation and transformation for companies that comes with economic and reputational benefits. With current emission levels, the data does indicate a difficult path ahead. Under present policies and no additional measures, emissions are set to reach 60 GtCO2. For a 1.5°C temperature rise limit, this should be 25 GtCO2, 58% lower than the projected amount. Even under fulfillment of all conditional National Nationally Determined Contributions, there will still be a gap of 53% between the projected and required emissions1. This data indicates a global temperature rise of 3°C, by 2100.

While this is a challenging task, companies that go green to bridge this gap will potentially lower operating costs and improve brand perception among their investors, customers, and other stakeholders.

The drive towards net zero is now picking pace, and there are various factors at play to push governments and corporates to act in time.

Software- Salesforce

Already achieving its greenhouse gas emissions in 2017, through measures like emission reduction and offsetting. Besides aiming for 100% renewable electricity for its global operations by 2022, and owning and occupying only net zero carbon buildings for operations by 2030, it is encouraging its top suppliers to set their own emission targets by 2025.

Investors seeking greener businesses: As astute businessmen, investors are realizing the potential risk as well as underlying opportunities attached to attaining net zero carbon emission goals. Investor lobbies around the globe are collaborating towards convincing businesses to rethink and innovate their ways of delivering services. Climate Action 100+, an initiative supported by 518 institutional investor organizations managing $47 trillion in assets, directed 161 fossil fuels, mining, transport and other big emitting companies to set targets and reporting in line with Paris agreement3. The financial sector is seeing more investor demands to show meaningful participation and legitimate results decarbonizing their operations. Fidelity International, Legal and General Investment with 33 other investors holding $11 trillion in assets under management, has urged 27 of the world’s largest banks including HSBC, Citigroup, and Barclays, to focus on scope 3 emissions and publish interim targets for emission reduction4.

Technological advancement accelerating transition: Technology is at the very foundation of the hope to achieve net 1.5°C temperature rise by 2100. Both present and future innovations are already being considered for this goal. While carbon capture, utilization and storage (CCUS) and hydrogen related fuels are in nascent stage, the cost of solar photovoltaics (PV) has fallen around 50 fold since 19765 and this trend is forecasted to continue. Battery storage costs have also fallen drastically over the decade by about 19%, with huge investments pouring in to keep production up6.

Mounting pressure from consumers: The increasing concern and awareness among the everyday consumer is pushing businesses to seriously rethink their stance on climate change. People today care for how they are impacting the environment with their consumption habits and looking for avenues to become more responsible citizens of this planet. Studies have shown customers are even willing to pay a premium for green products7.

Enactment of laws and policies: Currently, 121 countries have stated they have net zero ambitions, and seven have produced a framework designed to accomplish this goal. Countries like UK, Sweden and Netherlands are setting examples for the rest of the world to follow8.

How are industries contributing?

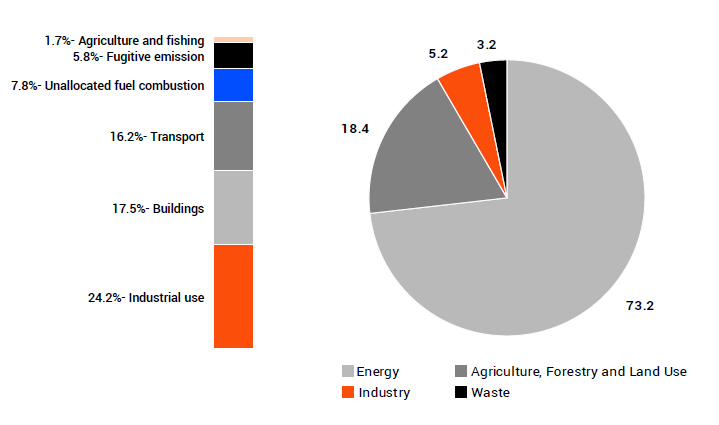

As is evident from the data, the energy industry is single handedly the largest emitter of greenhouse gases.

Not surprisingly, even among the largest emitting countries, energy takes precedent in transformation towards lower emissions. China still gets most of its energy needs met by burning fossil fuels. The biggest state-owned utilities in China are planning to add 305 GW of new wind and solar capacity in next five years9, as the country continues to increase its fossil fuel utilization faster than ever. The aim is to transition its energy mix without hampering growth avenues.

UK, on the other hand, is continuously setting aggressive targets and backing them up with laws. With a new target of cutting emissions by 78% by 2035, UK has quadrupled its renewable electricity generation since 2010 and signed the landmark North Sea Transition Deal to support oil and gas industry’s transition to clean and green energy while supporting 40,000 jobs10.

The compelling need to achieve ambitious goals doesn’t come without its challenges.

Long lived capital assets11: Typically the age of industrial plants is nearly 30-40 years, particularly in heavy industries. To retire plants early means incurring heavy costs, while relatively new plants must be retrofitted or modified to reduce emissions and keep the financials in check.

Massive upfront investment: Credit constraints significantly impact a firm’s ability to invest in green technologies due to the substantial investment required. Machinery and vehicle upgrades, improved heating and cooling, lighting, and green generation on site are high-value investments. However, investment in air and other pollution control measures or energy efficiency measures are still viable due to easy implementation and relatively lower costs12.

Absence of a well-defined framework: Accomplishing these expensive, intensive objectives will require policy makers across geographies to de-risk green investment opportunities and provide a roadmap for baselining these measures. Without a common standard, multiple interpretations can distract from long term goals and lessen the impact on emission reduction efforts13.

In the face of the staggering challenges, there are benefits to be reaped. The efforts put in today will be an investment with manifold returns in the future. There are energy companies who have realized this fact and are positioning themselves to be future ready.

Walking the talk…

FMCG- Unilever

Being one of the largest fast-moving consumer goods company, Unilever is eyeing to be carbon positive by 2030. It is currently using renewable grid electricity across five continents, investing in energy efficiency program and reducing total energy consumption by 28%, and halving carbon emissions per ton of production since 2008.

Transport- Mahindra

With the aim of achieving carbon neutrality across the entire Mahindra group by 2040, the giant conglomerate has progressed in achieving them as well by reducing total emissions (Scope 1, 2 & 3) by 14% in 2017- 18 compared to previous year.

Source: Unilever- Unilever’s Climate Transition Action Plan: Giving Investors A Say On Climate Targets Progress (forbes.com)

Mahindra- Company Profile: Mahindra Group - We Mean Business coalition

Salesforce- Salesforce Achieves Net-Zero Greenhouse Gas Emissions The company now provides a carbon neutral cloud for all customers - Salesforce News

Benefits of emission reduction

Reduced cost of operations Switching to renewables incentivizes firms to rebalance their energy mixes. While the combined cost to build, operate, fuel and maintain a coal-fired power plant comes around $60 to $143 per megawatt hour and $41 to $74 for natural gas power plants, the wind and solar power plants offer a much more lucrative deal. Similar costs for operating a wind and solar power plants are $29 to $56 and $40 to $60, respectively14. Realizing this as just one of the benefits, more and more utility companies are investing in renewable projects. By moving away from coal and diving into green energy, Orsted Energy has now emerged as a leader in offshore wind. It has led a cost reduction of around 60% through scale and industrialization15 and is now delving into renewable hydrogen.

Increased demand for renewable electricity leading to increased profitability. Global energy demands are projected to rise by 20%, with electricity demands rising by 60% by 204016. Companies fulfilling these demands with green energy will likely add significant gains to their bottom lines. The surging popularity of electric vehicles will not only serve as significant source for this coming demand, but even help in managing it via development of distributed energy systems. Duke Energy, a major US utility company, is helping to transforming cities in its territories by funding multiple electric transportation projects. Duke Energy has funded almost 200 EV charging stations in North Carolina17, solidifying its command in the sector to scale and expand in the future.

Increased valuation by gaining investor and public confidence. As mentioned earlier, both investors and public are now valuing companies not just based on their approach to going green. A great example of this is NextEra Energy. Being the biggest utility company in U.S., NextEra is also owner of the largest renewable energy project businesses in the country and this reflects in its valuations. In 2020, NextEra Energy surpassed big oil companies in market capitalization buoyed by retail and institutional investors’ interest to be a part of company investing in tomorrow, today18.

Improvement in customer service levels leading to increase in customer loyalty and retention. Meeting net zero demands can only become a reality with innovative solutions, and customers will be an integral part of those solutions. Collecting and analyzing consumer data to offer personalized products and services aiding reduced emissions, with the additional benefit of lesser bill amounts, is a win-win strategy. This is exactly what ENGIE is seeking. French multinational ENGIE in 2016 decided to become the world leader in transition to a zero-carbon future, formulating its strategy with its consumers at the center. With advanced technology infrastructure and 360 degree customer views, it has gained business efficiencies, lifted service levels and significantly reduced call volumes and duration for its call centers. ENGIE’s agent productivity has soared while the training time has been cut in half, all the while adding capacity to its renewable energy assets19.

How to achieve net zero?

Reduction

- Switching to renewable energy sources

- Minimizing travel costs using meeting softwares

- Efficient energy management in offices and data centers

- Reusing and recycling

- Minimal use of plastic and paper

Innovation

- Renewables with domestic and community microgeneration

- Grid modernization

- Blockchain for transactions settlement and microgrids

- Smart home technologies and sensor based consumption

Carbon capture

- Carbon sequestration

- Emission utilization for concrete and carbon nanotube production

Offsetting

- Voluntary offsets markets trading at nearly 100 million metric tonnes of CO2 equivalent at $300 million valuation

- Compliance offsets for legally binding caps on carbon in schemes like European Union’s Emission Trading System valued at $40 billion to $120 billion

Reduction

The first and foremost step any company can take is to reduce the current level of emissions to the least possible value. As cliché as this advice is, it can lead to substantial additional savings in terms of operations cost as well as contribute to emissions reduction.

Innovation

To augment the efforts of reducing current emission levels, one can also look into the source of their power. Encouraging use of renewable energy internally as well as among the consumers will further reduce scope 3 emissions.

As necessity begets invention, so is the rise of prosumers leading to paradigm shift in the energy sector. Regional implementation of microgrids for energy self-sufficiency, renewable portfolio standards, and feed-in-tariffs have successfully reduced emissions20. Investments to modernize the grid can also increase its resiliency towards shocks by considering distributed energy resources (DERs) as buffers, as well as reducing load on generation and transmission from main power plants.

Carbon capture

Hailed as a potential breakthrough technology to aid the global race towards carbon neutrality, carbon capture, use, and storage technologies can reduce more than 90% of CO2 emissions from industrial facilities and power plants. Currently, 26 commercial carbon capture plants are operating around the world, removing 36-40 million tonnes of carbon per year, with 21 more of these plants in the early development stage and 13 in advanced stages21.

Although the technology is not even close to what it is expected to become22, there have been some promising startups in this space. Among the top five startups impacting oil and gas industry are Carbon Infinity from China for direct air capture, Silicon Microgravity from Britain for CO2 sequestration monitoring, Industrial Climate Solutions from Canada for regenerative froth contactor, TerraCOH from US for CO2 plume geothermal technology, and Carbon Upcycling Technologies from Canada for carbon upcycling23. These are among hundreds of other startups which are currently operating and aiming to solve problems via different types of solutions and advance the field at a much faster pace.

Offsetting

Buying offsets to compensate for carbon emissions has become an option for companies and individuals. The offset market can be divided into either being voluntary and compliance driven, with a market cap of $300 million and $40-$120 billion, respectively. Offset programs like United Nations’ REDD+ program or Kyoto Protocol’s Clean Development Mechanism have under-delivered on the reductions target, hence the skepticism regarding the option24. Despite the current evaluation of it, offsets present enormous potential to deliver results on a global scale in comparatively shorter time period than other investments.

How EXL can help?

In pursuit of aspiring goals of delivering efficient, swift and noteworthy results, numerous technological innovations are being employed. Embedding operations with analytics, implementing robotic

process automation (RPA) at scale, recognizing and addressing the changing demands from prosumers, along with top of the line data management for advanced analysis could help any aspiring company to reach its short and long term goals.

At EXL, we are dedicated to provide the best service and become a long term partner through our expertise in advanced analytics, intelligent operations to deliver consistent growth and efficient operations. EXL is already at the heart of transforming businesses, be it helping save clients millions through robust RPA implementation25 or re-engineering and optimizing processes to increase human capital efficiency26.

With capabilities like robotics and AI centre of excellence, proprietary operations analytics framework driven by our Management Information Assistant solution, cutting edge data science services coupled with insight-generating business intelligence and reporting mechanisms, anyone can save their precious resources.

With a global presence with multilingual support, experts working across multiple geographies and industry standard beating service levels supported by numerous prestigious awards, EXL will strive to help you achieve new heights in the industry.

Conclusion

Companies can take various paths to achieve net zero goals but collecting, managing, and leveraging data will be a common link across the options. The only way to achieve this ambitious goal is through collaborative action. No individual, corporation, or country can achieve it on their own. Collaborating and sharing best practices will serve as the foundation for the next century.

1. EGR20ESE.pdf (unep.org)

2. Time for investors to move out of high-carbon assets, says UN climate change official | | UN News

UN climate chief urges investors to bolster global warming fight | Reuters

3. Investors that manage US$47tn demand world’s biggest polluters back plan for net-zero emissions | Climate change | The Guardian

4. Investors pile pressure on banks to align with net-zero emissions | The Actuary

5. Technology improvement and emissions reductions as mutually reinforcing efforts | MIT Energy Initiative

6. How battery storage and grid modernisation can accelerate the energy transition (smart-energy.com)

7. (PDF) Consumers Purchase Behavior towards Green Products (researchgate.net)

8. WEF_The_Net_Zero_Challenge.pdf (weforum.org)

9. The Chinese Government Needs to Become a Clean Energy Supermajor - Bloomberg

10. UK enshrines new target in law to slash emissions by 78% by 2035 - GOV.UK (www.gov.uk)

11. The challenge of reaching zero emissions in heavy industry – Analysis - IEA

12. Barriers to net zero: How firms can make or break the green transition (worldbank.org)

13. Utility Week - The regulatory road to net zero, 20 April 2021 | PA Consulting

14. Renewable Energy Prices Hit Record Lows: How Can Utilities Benefit From Unstoppable Solar And Wind? (forbes.com)

15. Whitepaper Summary: Making Green Energy Affordable (Chapter 1/6) | Ørsted (orsted.com)

16. The Top 10 Energy Market Trends to Watch in 2021 (energywatch-inc.com)

17. Electric revolution: As EV demand increases, can utilities and cities keep up? | Utility Dive

18. The utility that beat Big Oil to climate model it needs for future (cnbc.com)

19. Customer Demands Drive Change in Business Models (powermag.com)

20. The role of energy technology innovation in reducing greenhouse gas emissions_ A case study of Canada | Elsevier Enhanced Reader

21. Carbon Capture | Center for Climate and Energy Solutions (c2es.org)

22. Carbon capture technology not on track to reduce CO2 emissions (downtoearth.org.in)

23. 5 Top Carbon Capture, Utilization & Storage (CCUS) Solutions (startus-insights.com)

24. Carbon offsets, the popular climate change mitigation tactic, explained - Vox

25. RPA at Scale Saves a Utilities Company Millions (exlservice.com)

26. Establishing a Robotic Automation Center of Excellence (exlservice.com)

Written by:

Rahul Kumar

Manager, Utilities

Utilities Academy