EXL Reports 2019 Second Quarter Results

Tuesday, July 30, 20192019 Second Quarter Revenues of $243.5 Million, up 15.9% year-over-year

Q2 Diluted EPS (GAAP) of $0.36, down from $0.41 in Q2 of 2018

Q2 Adjusted Diluted EPS (Non-GAAP) of $0.74, up from $0.67 in Q2 of 2018

NEW YORK, July 30, 2019 (GLOBE NEWSWIRE) - ExlService Holdings, Inc. (NASDAQ: EXLS), a leading operations management and analytics company, today announced its financial results for the quarter ended June 30, 2019.

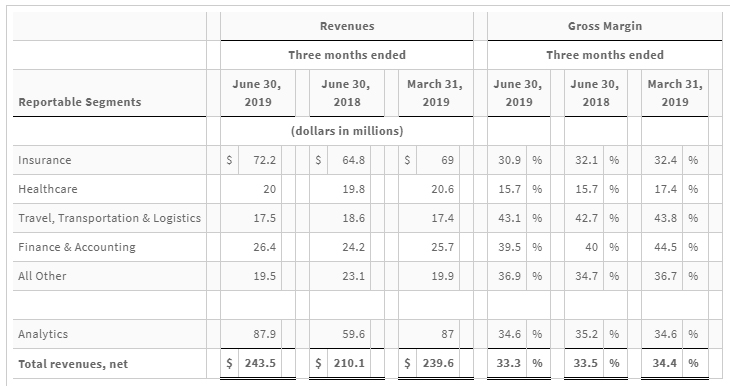

Rohit Kapoor, Vice Chairman and Chief Executive Officer, said, “EXL generated revenues of $243.5 million during the second quarter of 2019, up 15.9% year-over-year, and adjusted diluted EPS of $0.74, up 10.4%. EXL’s 47.4% increase in Analytics revenues was driven by a 15.9% increase in organic revenues and the acquisition of SCIOinspire Holdings, Inc. Operations management revenues growth was led by double-digit increases in Insurance and Finance & Accounting revenues.

“We had strong revenue growth in the first half of the year which was driven by our success in delivering innovative integrated operations management and analytics solutions.

“The wind down of the Health Integrated business is progressing as per plan and, as announced on Form 8-K/A of July 16, we expect to substantially exit the business in a responsible manner by year end.”

Vishal Chhibbar, Chief Financial Officer, said, “We are increasing our revenue guidance for 2019 to $976 million - $996 million from $969 million - $996 million to reflect better performance in the second quarter and our outlook for the remainder of the year. Our guidance now represents annual revenue growth of 11% to 13% on a constant currency basis. Our adjusted diluted EPS guidance for 2019 is being increased to $2.86 - $2.98 from $2.83 - $2.98. Our balance sheet remains strong with cash and short-term investments of $253 million as of June 30, 2019.”

Financial Highlights: Second Quarter 2019

We have six reportable segments: Insurance, Healthcare, Travel, Transportation & Logistics, Finance & Accounting, All Other (consisting of our Banking & Financial Services, Utilities and Consulting operating segments) and Analytics. Reconciliations of adjusted (non-GAAP) financial measures to GAAP measures are included at the end of this release.

- Revenues for the quarter ended June 30, 2019 increased to $243.5 million compared to $210.1 million for the second quarter of 2018, an increase of 15.9% on a reported basis and 16.8% on a constant currency basis from the second quarter of 2018, as well as an increase of 1.6% sequentially on a reported basis and 1.8% on a constant currency basis, from the first quarter of 2019.

- Operating income margin for the quarter ended June 30, 2019 was 5.7%, compared to an operating income margin of 8.1% for the second quarter of 2018 and operating margin of 7.0% for the first quarter of 2019. During the quarter ended June 30, 2019 and March 31, 2019 we recorded impairment and restructuring charges of $5.6 million and $1.2 million, respectively related to the wind down of the Health Integrated business, which reduced our operating income margin by 230bps and 50bps, respectively. Adjusted operating income margin for the quarter ended June 30, 2019 was 13.2% compared to 13.6% for the second quarter of 2018 and 12.8% for the first quarter of 2019.

- Diluted earnings per share for the quarter ended June 30, 2019 was $0.36 compared to $0.41 for the second quarter of 2018 and diluted earnings per share of $0.42 for the first quarter of 2019. During the quarter ended June 30, 2019 and March 31, 2019 we recorded impairment and restructuring charges of $5.6 million and $1.2 million, respectively related to the wind down of the Health Integrated business, which reduced our GAAP diluted EPS by $0.12 and $0.03, respectively. Adjusted diluted earnings per share for the quarter ended June 30, 2019 was $0.74 compared to $0.67 for the second quarter of 2018 and $0.71 for the first quarter of 2019.

Business Highlights: Second Quarter 2019

- Won six new clients in Q2 including two in our operations management businesses and four in Analytics

- Named among the fastest growing service providers by Everest Group in the 2019 Everest Group BPS Top 50

- Recognized by the IAOP for being the “best of the best” for Customer References, Innovation and Corporate Social Responsibility in the IAOP Best of the Global Outsourcing 100

- Recognized as a leading service provider in the HFS Top 10 Finance & Accounting Service Providers report

- Recognized as a Major Contender and Star Performer in the Everest Group Healthcare Payer Business Process Services PEAK Matrix™ Assessment 2019

- Appointed Samuel Meckey as Executive Vice President and Business Head, Healthcare

2019 Guidance

Based on current visibility, and a U.S. Dollar to Indian Rupee exchange rate of 69.0, British Pound to U.S. Dollar exchange rate of 1.22, U.S. Dollar to the Philippine Peso exchange rate of 51.0 and all other currencies at current exchange rates, we are providing the following guidance:

- Revenue of $976 million to $996 million, representing an annual revenue growth rate of 11% to 13% on a constant currency basis and which includes $10 million to $14 million of revenues from the Health Integrated business for 2019.

- Adjusted diluted earnings per share of $2.86 to $2.98, which includes adjusted EPS losses of $0.23 to $0.27 from the Health Integrated business and excludes one-time wind down costs of $8.5 million to $10 million.

Conference Call

ExlService Holdings, Inc. will host a conference call on Tuesday, July 30, 2019 at 8:00 A.M. ET to discuss the Company’s quarterly operating and financial results. The conference call will be available live via the internet by accessing the investor relations section of EXL’s website at ir.exlservice.com, where an accompanying investor-friendly spreadsheet of historical operating and financial data can also be accessed. Please access the website at least fifteen minutes prior to the call to register, download and install any necessary audio software.

To listen to the conference call via phone, please dial 1-877-303-6384, or if dialing internationally, 1-224-357-2191 and an operator will assist you. For those who cannot access the live broadcast, a replay will be available on the EXL website ir.exlservice.com for a period of twelve months.

About ExlService Holdings, Inc.

EXL (NASDAQ: EXLS) is a leading operations management and analytics company that designs and enables agile, customer-centric operating models to help businesses enhance revenue growth and profitability. Our delivery model provides market-leading business outcomes using EXL’s proprietary Digital EXLerator Framework™, cutting-edge analytics, digital transformation and domain expertise. At EXL, we look deeper to help companies improve global operations, enhance data-driven insights, increase customer satisfaction, and manage risk and compliance. EXL serves the insurance, healthcare, banking and financial services, utilities, travel, transportation and logistics industries. Headquartered in New York, New York, EXL has more than 30,000 professionals in locations throughout the United States, Europe, Asia (primarily India and Philippines), Latin America, Australia and South Africa. For more information, visit www.exlservice.com.

Continuing Statement Regarding Forward-Looking Statements This press release contains forward-looking statements. You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to EXL's operations and business environment, all of which are difficult to predict and many of which are beyond EXL’s control. Forward-looking statements include information concerning EXL’s possible or assumed future results of operations, including descriptions of its business strategy. These statements may include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are based on assumptions that we have made in light of management's experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although EXL believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect EXL’s actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. These factors, which include our ability to successfully close and integrate strategic acquisitions, are discussed in more detail in EXL’s filings with the Securities and Exchange Commission, including EXL’s Annual Report on Form 10-K. These risks could cause actual results to differ materially from those implied by forward-looking statements in this release. You should keep in mind that any forward-looking statement made herein, or elsewhere, speaks only as of the date on which it is made. New risks and uncertainties come up from time to time, and it is impossible to predict these events or how they may affect EXL. EXL has no obligation to update any forward-looking statements after the date hereof, except as required by federal securities laws.

For a full view of EXL’s financial tables, click here